Risk Management Maturity Models: Your Compass to Risk Excellence.

.. and other exciting reads.

Imagine the Risk Maturity Model as your organisation's secret recipe for mastering risk management. It's like a board game, moving from simple, beginner-level strategies to more complex, grandmaster-level tactics. As you traverse the game, you're not just playing - you're learning, identifying your weaknesses, and transforming them into strengths. These models are like your personal roadmap to success, helping you gauge your current position, spot the potholes, and plot the course to your destination - a more risk-aware organisation. So, when do we roll the dice? During risk check-ups, when we're sketching out strategic plans, and when we're gearing up to enhance our processes. Let's get ready to conquer the game of risk management!

More Formally

A Risk Management Maturity Model (RMMM) is a structured approach for evaluating an organisation's risk management capabilities and processes. It provides a framework to assess the maturity of risk management practices, identify gaps, and guide improvement efforts. RMMMs enable organisations to benchmark their risk management processes against industry best practices and set targets for continuous improvement.

Existing Maturity Models

There are several standard Risk Management Maturity Models available, each with its focus and methodology. Each different model supports different sets of circumstances, and will help drive improvements in different directions. In nearly all scenarios, Organisations would look to develop a Maturity Model that fits their circumstances and the outcomes they are trying to achieve. The following set of widely recognised models will often form the basis.

- Committee of Sponsoring Organisations of the Treadway Commission (COSO) Enterprise Risk Management (ERM) Maturity Model: This model focuses on the integration of risk management with an organisation's strategy and performance. It evaluates maturity across five components: governance and culture, strategy and objective-setting, performance, review and revision, and information, communication, and reporting.

- Project Management Institute (PMI) Organisational Project Management Maturity Model (OPM3): This model assesses the maturity of project, program, and portfolio management practices within an organisation, including risk management. OPM3 evaluates maturity based on standardised best practices and helps organisations identify areas for improvement.

- Capability Maturity Model Integration (CMMI): While not specifically designed for risk management, CMMI provides a framework for assessing and improving process maturity across various disciplines, including risk management. CMMI's risk management component focuses on identifying, analysing, and mitigating risks throughout the project lifecycle.

- Australian/New Zealand Standard for Risk Management (AS/NZS ISO 31000): This standard provides a set of principles and guidelines for effective risk management. It can be used as a basis for assessing risk management maturity by evaluating an organisation's adherence to the standard's principles and recommended practices.

Building and Tailoring your Risk Management Maturity Model

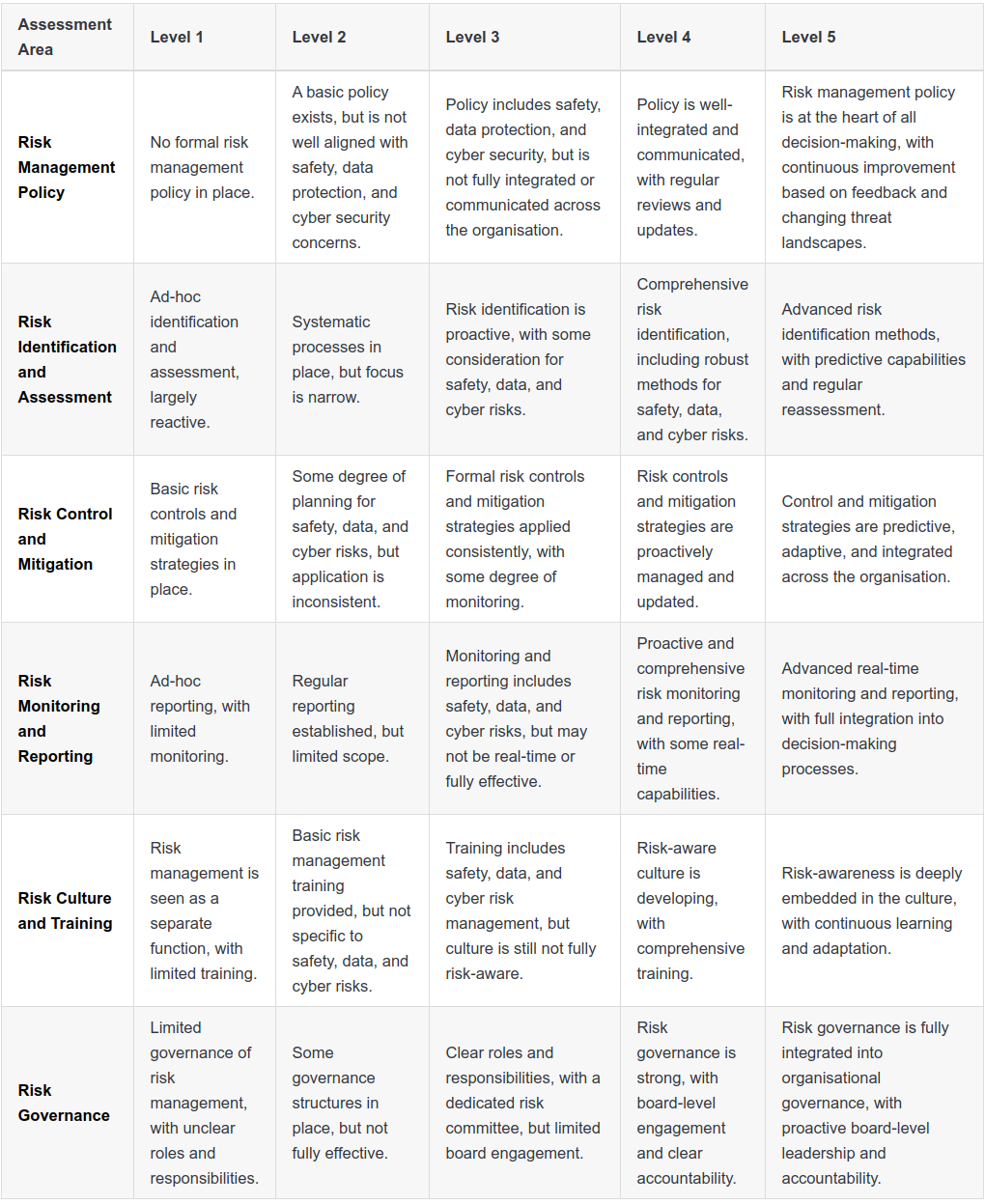

The Risk Maturity Model often comprises several assessments that help evaluate the organisation's level of risk management maturity. Here is a summary of the typical assessments ( or dimensions ) that you will often see as part of most RMMM's, and what they involve:

- Risk Management Policy: This assessment evaluates whether the organisation has a well-defined risk management policy in place. Key factors include the policy's clarity, its alignment with the organisation's goals, and whether it is communicated effectively to all employees.

- Risk Identification and Assessment: This measurement looks at how effectively risks are identified and assessed across the organisation. This includes the methods used for risk identification, the thoroughness of risk assessments, and the incorporation of risk assessment in decision-making processes.

- Risk Control and Mitigation: This dimension assesses the strategies and processes in place to control and mitigate identified risks. Key factors include the effectiveness of controls, the appropriateness of risk mitigation strategies, and the integration of these strategies into the organisation's operations.

- Risk Monitoring and Reporting: This assessment focuses on the systems used to monitor and report on risks. It looks at the frequency and comprehensiveness of risk monitoring, the effectiveness of reporting mechanisms, and how well risk information is communicated throughout the organisation.

- Risk Culture and Training: This evaluation reviews the organisation's culture regarding risk and the level of risk management training provided to staff. This includes the extent to which risk awareness is embedded in the organisation's culture, the quality and frequency of risk management training, and the level of staff engagement in risk management.

- Risk Governance: This assessment measures how well risk management is governed at the highest levels of the organisation. It considers factors like the role of the board in overseeing risk, the existence of a dedicated risk committee, and the clarity of roles and responsibilities in relation to risk management.

Tailoring your RMMM to your needs.

The effectiveness of a Risk Maturity Model lies in its adaptability to the unique circumstances and needs of a specific organisation. Here's how you can customise the assessment criteria:

- Understand the Organisation's Context: Before starting the assessment, gain a thorough understanding of the organisation's strategic objectives, its operational context, and the nature of risks it typically encounters. This will inform how you adapt the criteria.

- Risk Management Policy: Customise this assessment by focusing on the specific goals and operations of the organisation. For example, if the organisation operates in a highly regulated industry, the policy should reflect regulatory compliance as a key factor.

- Risk Identification and Assessment: Adapt this assessment to the types of risks the organisation is most likely to encounter. For example, a tech company might place a higher emphasis on cybersecurity risks, while a manufacturing firm might focus more on operational and safety risks.

- Risk Control and Mitigation: Tailor this assessment by considering the organisation's risk appetite and capacity. Some organisations may prefer more aggressive risk mitigation strategies, while others might opt for a more balanced approach.

- Risk Monitoring and Reporting: Customise this criterion based on the organisation's structure and communication channels. A larger organisation might require a more formalised and frequent reporting mechanism compared to a smaller firm.

- Risk Culture and Training: Adapt this evaluation to reflect the organisation's culture and workforce. If the organisation has a diverse workforce, for example, it may need to use multiple training methods to effectively build risk awareness.

- Risk Governance: Tailor this assessment based on the organisation's governance structure. If the organisation has a more decentralised structure, the role of local risk committees might be a key consideration.

Remember, the main aim is to ensure the Risk Maturity Model reflects the unique characteristics and needs of your organisation. The model should serve as a practical tool that supports the strategic objectives and enhances its risk management capabilities. The best outcomes are achieved when the assessment criteria is a mirror of the organisation's reality, and not a one-size-fits-all checklist.

An Example

We will develop a simple example, for an organisation. As with all Risk Management Maturity Models, they become useful, easier to adopt and deliver better outcomes when they are tailored to a specific organisation.

For our example, we will build an example based on a Large Public Sector Organisation with a high Safety Critical nature, concerned also around public reputation, protecting citizen and employee personal data, confidential information aligned to national critical infrastructure, and cyber resilience from hostile actors/threats. Our model will use the six dimensions or assessments we identified above, to provide a RMMM that can capture, track and report progress.

This model emphasises safety, data protection, and cyber resilience, recognizing the unique risks that the organisation faces. The ultimate goal being to reach Level 5, where risk management is fully integrated into all aspects of the organisation's operations and decision-making processes.

Benefits of a Risk Management Maturity Model

A well-tailored RMMM helps you identify where you stand in terms of risk management and provides a roadmap to improve, making sure no stone is left unturned. It fosters a proactive risk culture, allowing you to anticipate and mitigate risks before they escalate. This not only strengthens decision-making but also boosts stakeholder confidence, elevates your organisation's resilience, and ultimately drives sustainable growth These benefits can be summarised:

- Benchmarking: RMMMs enable organisations to compare their risk management practices with industry best practices and standards. This helps identify areas where improvement is needed and set realistic targets for enhancement.

- Prioritisation: By assessing the maturity of risk management practices, organisations can identify the most critical gaps and prioritise improvement efforts accordingly.

- Continuous Improvement: RMMMs provide a structured approach to track progress and measure improvement in risk management capabilities over time.

- Alignment with Organisational Objectives: By aligning risk management practices with organisational objectives, RMMMs help organisations focus on managing risks that matter most to their strategic goals.

Using your RMMM

To use a Risk Management Maturity Model to direct change activity, risk teams will typically follow the following steps.

- Select an appropriate RMMM: Choose a model that aligns with the organisation's risk management objectives and industry context.

- Conduct a baseline assessment: Evaluate the organisation's current risk management maturity using the chosen model. This involves assessing risk management practices, processes, and capabilities against the model's criteria or best practices.

- Identify gaps and improvement opportunities: Analyse the results of the baseline assessment to identify areas where the organisation's risk management practices fall short of the desired maturity level.

- Develop a risk management improvement plan: Prioritise the identified gaps and improvement opportunities, and create a plan to address them. This plan should include specific actions, timelines, and resources required to enhance risk management maturity.

- Implement the improvement plan: Execute the risk management improvement plan, ensuring that stakeholders are engaged and committed to the process.

- Monitor progress and reassess maturity: Continuously monitor the organisation's progress in implementing the improvement plan and reassess its risk management maturity at regular intervals. This allows for adjustments and further improvements as needed.

By using a Risk Management Maturity Model, organisations can effectively assess their risk management capabilities, identify areas for improvement, and direct change activity to enhance their risk management practices and align them with organisational objectives.

In Conclusion

And there you have it - our thrilling adventure into the world of the Risk Management Maturity Model (RMMM). Just like a hero's journey in a story, an RMMM is all about progression and evolution, guiding organisations from the novice stage to become masters in managing risks.

While several existing maturity models offer a solid foundation, the magic happens when we tailor the model to fit an organisation's unique circumstances. Like our example RMMM tailored for a large public sector organization, the journey should reflect your organisation's particular landscape, whether it's dealing with safety-critical operations, data protection, or cyber threats.

But what's the treasure at the end of this journey? Well, a robust RMMM can turn risks from daunting foes into strategic allies. It enhances decision-making, boosts stakeholder confidence, strengthens your organisation's resilience, and drives sustainable growth. And most importantly, it instils a culture of risk-awareness throughout the organisation.

So, how do you embark on this epic journey? Start by understanding your current risk management capabilities and then use the RMMM as your roadmap. Remember, it's not about racing to the finish line, but about continuous improvement and evolution.

In the end, the RMMM isn't just a tool or a model, it's a compass that steers your organisation towards resilience and success. So, gear up and let's conquer the world of risk management together!

References

There are many useful publications and materials on this subject. We include a number below, some of which we have referenced and used to support some of the findings. We encourage you to explore this material as it can help set context or provide additional information. All rights reserved, All Trademarks Acknowledged, and all original content referenced is owned by the third parties identified.

- Fraser, J., & Simkins, B. (2010). "Enterprise Risk Management: Today's Leading Research and Best Practices for Tomorrow's Executives". John Wiley & Sons. This book provides a comprehensive overview of enterprise risk management, including maturity models.

- Hopkin, P. (2018). "Fundamentals of Risk Management: Understanding, Evaluating and Implementing Effective Risk Management". Kogan Page Publishers. This book provides a thorough introduction to all aspects of risk management, including the use of maturity models.

- COSO (Committee of Sponsoring Organizations of the Treadway Commission) (2017). "Enterprise Risk Management: Integrating with Strategy and Performance". This framework from COSO provides a detailed approach to risk management, including the concept of maturity models.

- The Risk Management Society (RIMS). (2015). "RIMS Risk Maturity Model for Enterprise Risk Management". This report provides a specific model for assessing risk management maturity.

- Deloitte (2013). "Risk Maturity Models: Understanding the Components". This article provides a detailed overview of the components of a risk maturity model.

- ISACA. (2012). "COBIT 5 for Risk". This guide provides a framework for managing IT-related risk, including a maturity model.

Please note that availability of these resources may vary, and some may be behind a paywall or require purchase.